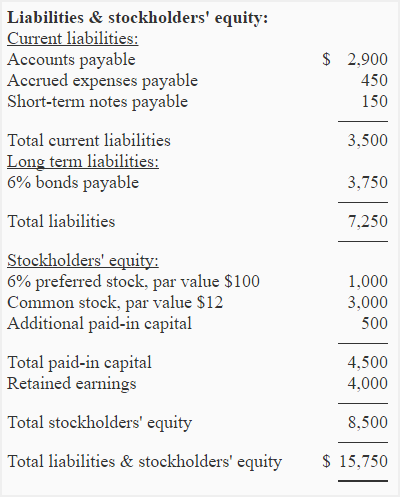

Eventually interest rates will come down again and then preferred-stock prices will move up significantly. This year has been brutal for funds that invest in bonds and preferred stocks. But any income investor must expect securities’ market values to move in the opposite direction of interest rates. These instruments are only appropriate for long-term investors who want income. Preferred stockholders have an ownership interest in a company’s net worth.

- Be forewarned, however, that depending on the size of the issue, the bid-ask spread on a preferred stock can be comparatively wide.

- A preferred stock is different from a common stock in that its owner has no voting rights.

- Despite the higher AFFOs, the per-share metric declined due to an even larger increase in the company’s share count, which was utilized to fund its acquisitions.

- Since they rank below traditional bonds, have very long maturities, and don’t enjoy the same income payment priority as traditional bonds, investors tend to demand higher yields to compensate for those risks.

The company has five core business units which include cash flow, asset-based, life science lending, equipment finance, and corporate leasing. The net interest spread came in at 0.23% and the adjusted net interest spread, a non-GAAP measure, came in at 1.12%. In some cases, the fixed rate of dividend payments can be a disadvantage. In other words, they’re really “preferred” by investors looking for a more secure dividend and lower risk of losses. But many of the best blue chip companies are also those that pay dividends.

Financial Calendars

Most preferreds with a $25 face value—the so-called retail market—trade on the New York Stock Exchange. This makes them more liquid and transparent than either corporate or municipal bonds, which change hands in the more-opaque over-the-counter market.

- If you don’t want to analyze balance sheets, as a rule of thumb, avoiding preferreds issued by firms whose common stocks are trading below $20 per share should keep you out of trouble.

- In general, the higher the yield, the more attractive the company is as an investment choice.

- Nine youths – including a 5-year-old child – were wounded after shots rang out at a gas station in a Georgia city bordering Alabama, authorities said Saturday.

- In addition, stocks that have high dividend yields are also attractive for income investors.

- Their rate remains unchanged throughout the maturity life of preference share.

- Preferred shares are shares issued by a corporation as part of its capital structure.

- Distributable Earnings were $38.8 million, which represents $0.32 per common share.

It pays a monthly dividend that has oscillated between 7.1 and 7.2 cents a share over the past year. If we go with the 7.1 cents and the closing price of $15.04 on Sept. 28, the current yield for a new investor is 5.66%. At the end of 2021, based on the closing price of $18.82, the current yield was 4.53%. Wells Fargo capital issuances include preferred stock, depositary shares and trust preferred securities, some of which are listed on the New York Stock Exchange, as well as private transactions.

Preferred Stock – Investment Grade

One reason is that if a company has an unprofitable year and pays no federal income taxes, its preferred dividends may not be considered “qualified” that year by the Internal Revenue Service. When a preferred security matures or is called , security holders usually receive the par value.A bond’s current price is set by market conditions, and is especially sensitive to changes in interest rates. Ownership is held in the form of depositary shares, each representing a 1/1200th interest in a share of preferred stock, paying a quarterly cash dividend, if and when declared. Ownership is held in the form of depositary shares each representing a 1/1000th interest in a share of preferred stock paying a quarterly cash dividend, if and when declared. The biggest risk I can see with the stock is that they’re less liquid than common stocks.

1 dividend stock I’m buying for lifelong passive income – Yahoo Eurosport UK

1 dividend stock I’m buying for lifelong passive income.

Posted: Sat, 18 Feb 2023 06:14:00 GMT [source]

Let’s take a closer look at https://personal-accounting.org/ shares to help you determine if preferred stock could be an appropriate part of your conservative dividend portfolio. Ellington’s book value per share declined from $16.22 to $15.22 during the last three months, with its dividend exceeding the underlying earnings. In addition, stocks that have high dividend yields are also attractive for income investors. For this reason, we created a full list of 49 monthly dividend stocks. Apple’s gradual growth, paired with its increasing dividend payout, is an attractive combination.

High-Yield Monthly Dividend Stock #13: Dynex Capital (DX)

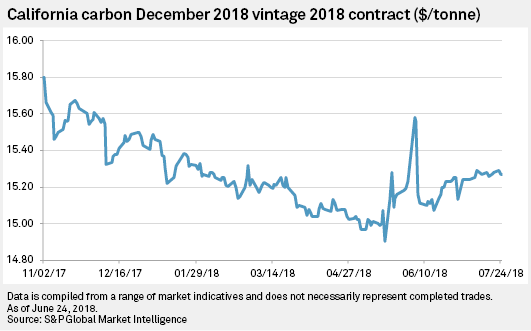

That happened during the global financial crisis in 2008 and then again in the first few months of 2020 during the early stages of the COVID-19 pandemic. Preferred stocks often offer high yields and solid income security, making them a potentially appealing choice for retirees looking to live off passive income. My rule of thumb is a minimum 4% for investment grade preferreds and 5%t for unrated preferreds. Since many preferreds are not called until long after the call date, your actual return will probably exceed the calculated number. The 20 stocks on this list have not been vetted for dividend safety, meaning each investor should understand the unique risk factors of each company. Due to its pure upstream nature, Hugoton is highly sensitive to the cycles of gas prices. Between April 2018 and October 2020, the costs of the trust exceeded its revenues due to suppressed gas prices.

Harry Potter wouldn’t be “The Boy Who Lived” if there was no Voldemort. Bear markets are the perfect antagonist for us to take suitable enrichment actions. Rather than running away from them in fear, we must use them to boost our cash flow and enter the upcoming bull market with a more robust portfolio. That’s not exactly a strength given that Jerome Powell has sent interest rates to near-zero and likely won’t change that anytime soon. But that makes its outperformance in recent years all the more impressive.

Company

A preferred stock is different from a common stock in that its owner has no voting rights. Preferred stockholders also have preference over common stockholders in the event a company is liquidated. To make it simple, if a company goes bankrupt and is liquidated, bondholders are paid first, then preferred shareholders and then common shareholders. A company in financial distress may suspend its payment of preferred security dividends.

Preferred Stocks That Pay High DividendsInvestor.com features a variety of tools, articles, and resources designed to help investors interested in dividend stocks find the best dividend stocks to buy. We provide opinion articles, detailed dividend data, history, and dates for every dividend stock, screening tools, and our exclusive dividend all star rankings. To be fair, SPFF has been an underperformer for most of its life since inception in July 2012. However, it held up better than most preferred stock ETFs in the dregs of 2022, thanks in part to its superior yield – a yield that’s paid monthly, by the by. Banks are far better capitalized and regulated now than they were in 2007, so the risk of another near-collapse doesn’t seem as dire.